We at Common Prefix are thrilled to announce that we are taking the lead stewardship role of the Axelar Network and its ecosystem. We are honored to be taking over the technology, product, and vision of Axelar. Let’s discuss the roadmap of what is to come.

In summary, in 2026, we will focus on:

- Revisiting incentives: Sever connections with underperforming chains so that we can focus our energy on the ecosystems that matter, ensuring the right incentives for validators and beyond are in place.

- Co-staking: Enable co-staking of blue chip assets to increase economic security.

- Institutional readiness: Make Axelar institutionally ready by exploring solutions around privacy, compliance, and robustness.

- Gasless bridging: Explore gasless bridging, in which users can bridge with zero fees, by leveraging idle gateway capital.

- New asset classes: Build protocols and new asset classes up the stack in promising ecosystems to grow the Axelar Network and its community.

More details follow.

Common Prefix has been working with Axelar over the past four years, since 2021, even before Axelar launched its public network. We audited the first gateway smart contracts that enabled moving value between Ethereum and Axelar. Over the years, we deepened our collaboration with Axelar, becoming the primary developer of the ecosystem together with Interop Labs, building a series of complex integrations such as with the XRP Ledger, one of the most voluminous Axelar integrations. We will launch some of our integrations in Q1 2026 and beyond.

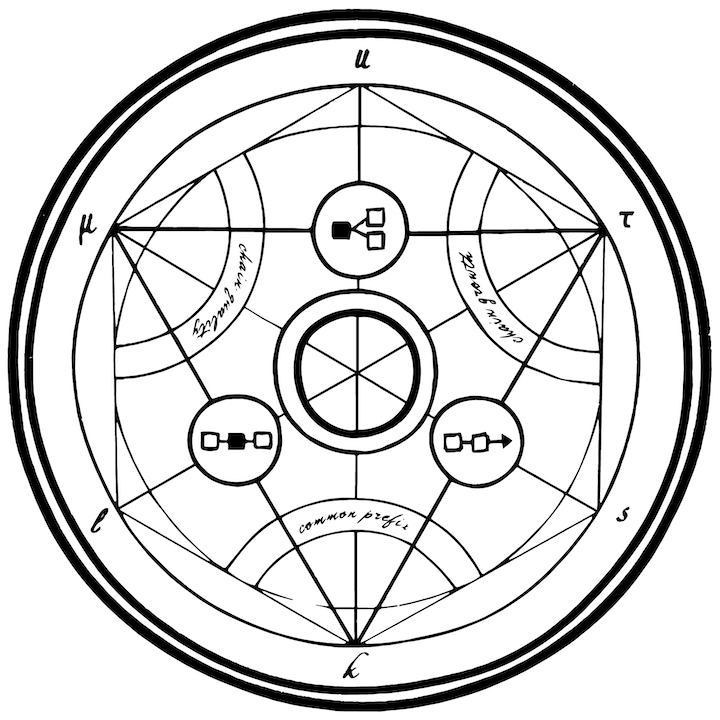

We strongly believe in Axelar’s state-of-the-art technology. Among all interoperability protocols, Axelar is the only one that is truly permissionless, featuring a fully fledged proof-of-stake network with real value locked operating using Tendermint. Its unique hub-and-spoke model enables firewalling, a security feature ensuring that the broader ecosystem can remain secure even if one of the individual chains fails.

Common Prefix is a team of scientists and engineers. Our scientists are post-docs, PhDs, and professors with strong academic backgrounds from renowned universities worldwide such as Stanford University, ETH Zürich, Imperial College London, University of Edinburgh, University of Vienna, IT University of Copenhagen, and the University of Athens. Our members were the first to prove proof-of-stake is secure. In interoperability, we pioneered the idea of wrapping tokens and trustless bridges in proof-of-stake and proof-of-work. In 2018, we invented the direct observation and certificates paradigm that Axelar uses to interoperate. Beyond world-class scientists, Common Prefix comprises a team of senior software engineers with decades of experience from managing the adversity of distributed systems and the latency of hedge funds, to web3 protocols and building bridges.

We are an unapologetically multichain team, with deep expertise in Ethereum, XRP Ledger, Sui, Solana, Cosmos, and Bitcoin (having co-invented BitVM). We believe in a multichain world, where different chains can be used for different purposes. Axelar’s interoperability layer is an indispensable component that enables them to communicate.

Our vision is to bring mainstream adoption of blockchain and trust technologies. Mainstream adoption pertains to the movement of real capital, affecting real peoples’ lives and work. This translates to getting these technologies adopted by institutions, whether financial or otherwise. Today, institutions consist of disparate systems built on different platforms that speak different languages and are in need of harmonization. Harmonization of disparate systems is interoperability, and chain interoperability has already become a keyword of institutional parties in 2025. We’re deepening Axelar’s existing commitment to serve these institutional parties, and are continuing to adapt Axelar’s technologies to make them institution-ready. As part of our commitment to this, we are focusing our energy on some of the key connections Axelar is enabling, like XRPL, Solana, Sui, Ethereum, Stellar, Hyperliquid, making sure the supported connections bring value to the ecosystem and the right incentives for validators. We will soon sever some of the barren connections that Axelar currently maintains, so that we can stay lean and focus our energy on the connections that matter.

We have a rich roadmap planned for 2026, with more detailed announcements coming in Q1 and Q2. We’d like to give the short version here.

Our vision for Axelar is to turn it into the backbone that financial institutions use to interoperate. When institutions adopt Axelar, they are replacing centralized systems that incur counter-party risk. This counter-party risk is translated, in a very real way, to economic security. For large-scale institutions, such as central banks, security remains as critical as ever, especially in a geopolitical climate where state-level threats are a daily concern. In this context, we strongly believe that Axelar’s pioneering technology provides the definitive answer to the security question through its permissionless, hub-and-spoke system. The Axelar network has bridged $13B in cross-chain volume throughout its existence. We’ve only scratched the surface. But to get there, we must increase economic security. In 2026, we will allow other blue-chip tokens to be “co-staked” to secure the network, drastically increasing the total economic security and making the network trustworthy for mass institutional adoption. In addition, institutions demand privacy, compliance, and robustness, and we’ll make sure Axelar is upgraded to serve these needs.

While security and robustness sits at the heart of the system, everyday users face different pain points when bridging tokens. Friction exists in having to cross multiple bridges manually, paying gas in every step along the way, and incurring liquidity costs when capital is locked or delayed. Until these points of friction are removed, these bridges will remain underused. In 2026, we will announce more details on our gasless bridging scheme, which will allow users to transfer assets without incurring gas fees (under usual use cases). The way we can subsidize these gas costs is by utilizing the idle capital that sits on gateway contracts on the periphery of the hub-and-spoke system, for example locked up Ether that sits on the gateway smart contract on Ethereum. This capital investment will always be a choice that remains with the user based on their risk appetite, giving birth to new asset classes.

Lastly, we will devote significant efforts into building applications “up the stack” that utilize Axelar’s interoperability technologies. The use cases for 2026 with clear, viable commercial applications are stablecoins, tokenized deposits, yield and lending protocols. We will build and deploy products around these verticals to key ecosystems such as XRPL and Solana where these can flourish. New asset classes, such as mXRP, have been successful examples of building up the stack. A fusion of new chains creates an opportunity of new emerging asset classes around the yield and trading verticals. We’ll focus on creating assets that support the ecosystem sustainably.

In closing, we are a team of scientists who work from first principles with provable security in mind, but also pragmatic engineers who ensure protocols are built, deployed, and used, with commercial viability always in mind. The community is an indispensable part of Axelar, and we need your support to realize this vision. We hope you join us in our journey.